What are the norms of bringing USD on your Cheap Flights from USA to India?

Will technological, geopolitical, and financial market changes diminish the dollar’s importance in the global economy? This piece updates previous analysis with thoughts on whether recent events, such as the pandemic and Russian sanctions, may influence the function of the dollar. So far, the evidence indicates to the US dollar maintaining its worldwide prominence, in our opinion. A companion piece discusses the Inaugural Conference on the International Roles of the US Dollar, sponsored on June 16-17 by the Federal Reserve Board and the Federal Reserve Bank of New York.

Why is the US Dollar regarded as the world’s strongest currency?

In today’s world, almost 80% of global trade is conducted in dollars. Approximately 39% of the world’s loans are made in US dollars, while 65% of the dollar supply is used outside of the US. Surprisingly, the majority of the world’s trade countries accept payment in dollars. This is why foreign banks and governments require dollars for international commerce.

Despite trillions of dollars in foreign debt and ongoing significant deficit expenditures, the US retains worldwide trust and confidence in its capacity to meet its obligations. As a result, the US dollar remains the strongest global currency. It may continue to be the world’s most valuable currency in the coming years.

In the instance of India, 86% of its imports are invoiced in dollars, even though just 5% of India’s imports originate in the United States. Similarly, 86% of India’s exports are invoiced in dollars, even though just 15% of India’s exports are to the United States. While China accounts for 16% of India’s imports, the majority of them are billed in dollars.

If you are planning a vacation to India, the first thing you should do is book cheap flights from USA to India. Second, visiting and exploring this gorgeous nation is a fantastic idea. From delectable cuisine to breathtaking monuments, India has a lot to see and do.

Are you wondering how much USD you may bring from India without being restricted? Perhaps you’re wondering if there’s a cash restriction on overseas flights.

Fortunately for you when coming to India, you are normally allowed to bring as much USD (or any foreign money) as you like to India. However, you should be aware that in some cases, you may be forced to report the cash upon arrival at your destination.

In this article, we answer the subject of how many dollars you may bring from India, the alternatives to carrying cash when traveling overseas, and the disclosure requirements in the United States.

What are the norms for importing Foreign Currency?

There is no restriction for tourists coming by direct flight tickets from USA to India on the amount of US money you can bring into or out of India. However, there is one disclaimer: any currency above $5,000 in cash or $10,000 in cash plus traveler’s checks must be disclosed in India.

Because carrying USD out of India requires the currency FX to have been taken into the nation at some point, customs laws still apply. When it comes to introducing foreign banknotes into India, the RBI says:

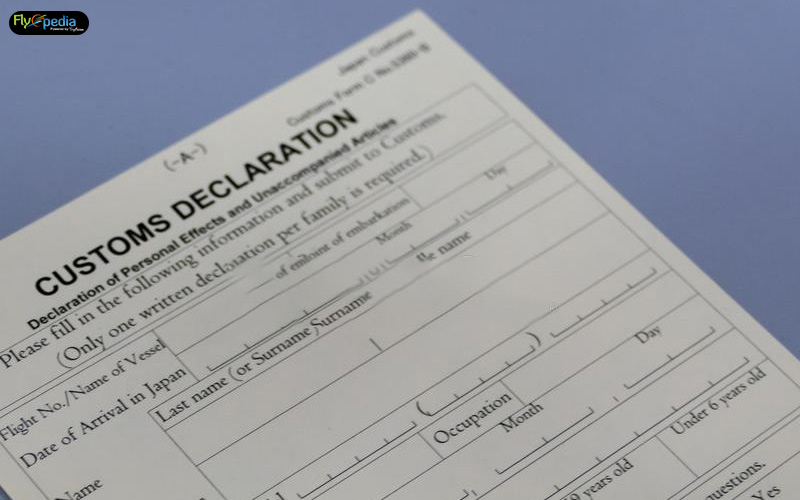

“Foreign currency can be brought into India without restriction. If the value of the foreign currency in cash exceeds US$ 5,000 and/or the cash plus TCs exceeds US$ 10,000, it must be notified to customs officials at the airport on arrival in India using the currency declaration form (CDF).”

What Are the Consequences of Bringing Too much USD Cash to India?

If someone does not obey the rules for carrying cash, it may result in the confiscation of all cash, the application of harsh penalties, or even arrest and prosecution. Foreign currency can be brought into India by passengers who book cheap flights from USA to India without restriction. If the value of the foreign currency in cash exceeds US$ 5,000 and/or the cash plus TCs exceeds US$ 10,000, it must be notified to customs officials at the airport on arrival in India using the currency declaration form (CDF).

What is the cash limit set by Indian Customs?

Any individual, resident, NRI, or tourist coming by direct flight tickets from USA to India, is permitted to bring any quantity of foreign cash or USD into India. Cash or foreign money (USD) must be disclosed before customs officials on duty, according to the Central Board of Direct Taxes and Customs. If you choose to violate these customs restrictions, your money may be taken, a fine levied, and in extreme situations, you may be arrested and prosecuted.

The Reserve Bank of India has imposed severe limitations on the maximum amount of money/cash that international tourists, NRIs, and Indian citizens can bring with them to Indian airports when flying by cheap flights from USA to India.

Important suggestions for avoiding cash issues at the airport

- If you are carrying a great amount of foreign currency from overseas, complete the Currency Declaration form, have it stamped by customs, and keep it with you when returning.

- If you acquire foreign money in India from an authorized dealer or bank, retain all transaction receipts.

- Keep no more than Rs. 25000 in Indian rupees on any trip transaction. If you are traveling to or from Nepal or Bhutan, be aware of the extra limitations.

Is there any tax on the foreign currency I bring into India?

There is no tax on foreign cash imported into India. If the currency value exceeds USD 5000 or the foreign exchange exceeds $10,000, you just need to file a declaration.

How to report to Indian Customs officials upon arrival?

Indian Customs Declaration Forms are available at customs offices at Indian international airports (CDF). As previously discussed, they can also be made available on flights or downloaded ahead.

Another option is to make a declaration in advance using the ATITHI Application. It is a simple mobile phone application that lets all international tourists who book last minute flights to India submit their declarations for all dutiable commodities and currencies before boarding their trip to India.

What Is Considered Cash?

Cash includes coins, currency notes, monies on deposit with a bank, checks, and money orders. Traveler’s cheques can be used to calculate your cash total.

Is it necessary for every tourist arriving in India to complete a Customs Declaration Form?

No, only travelers carrying dutiable or prohibited goods must complete a Customs Declaration Form or utilize the ATITHI mobile app to register a declaration of dutiable products and money with Indian Customs prior to boarding the aircraft to India.

Finally, bear in mind that the nation you’re going may have limits on the amount of cash you may carry with you. Make sure you’ve done your research on the nation you’re going.